News & information

Economics

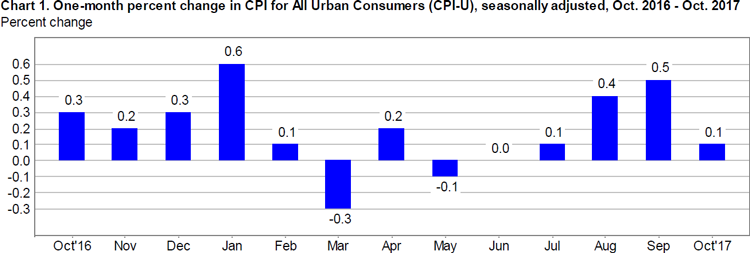

The Bureau of Labor Statistics released the Consumer Price Index for All Urban Consumers (CPI-U) today. Overall prices rose 0.1 percent in October, a slower rate of increase in consumer prices than the 0.5 percent increase September 2017. The slower increase in consumer prices has driven down the 12-month all-items index from 2.2 percent in September to 2 percent. The graph below from the BLS shows the seasonally adjusted percent change in prices over a 12-month period ending in October.

A main driver of the decelerating price increases is a significant decline in the energy index, as gasoline prices declined 2.4 percent in October after a rise of 13.1 percent in September. This is most likely the result of market adjustments in the wake of hurricanes in energy-rich areas of the Gulf of Mexico in September.

The overall energy index fell 0.1 percent, down from a rise of 6.1 percent in September. Food prices remained flat in October after a decrease of 0.1 percent in September.

The index for all items less food and energy, referred to as the “core price index,” was slightly higher than the broader index at 0.2 percent in October. This was mostly driven by increases in the prices for medical care as medical care services prices rose 0.3 percent after a rise of 0.1 percent in September, and medical care commodities prices remained flat after a decline of 0.8 percent in September. The prices for used cars rose 0.7 percent after a decline of 0.2 percent in September. The core price index increased 1.8 percent over a 12-month period ending in October, a 0.1 percentage point increase over the 12-month period ending in September.

Higher increases in the core index, the largest since April, have the potential to clear the way for an increase in the benchmark interest rate by the Federal Reserve in December as firmer inflation also suggests a higher demand for goods and services. However, slow growth in real earnings will dampen this demand even as unemployment remains low at 4.1 percent in October.

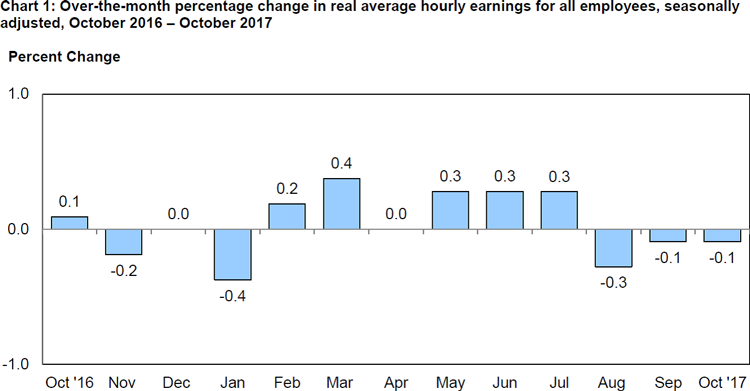

According to data released by the BLS today, real average hourly earnings for all employees decreased 0.1 percent in October, as a result of both a 0.1 increase in the CPI-U and no change in the average hourly earnings. Real average hourly earnings have increased 0.4 percent over a 12-month period ending in October.